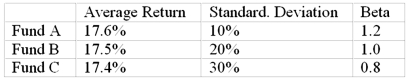

You want to evaluate three mutual funds using the Jensen measure for performance evaluation.The risk-free return during the sample period is 6%, and the average return on the market portfolio is 18%.The average returns, standard deviations, and betas for the three funds are given below.  The fund with the highest Jensen measure is

The fund with the highest Jensen measure is

Definitions:

Discount Rate

The interest rate charged to commercial banks and other financial institutions for loans received from the central bank's discount window.

High-risk Projects

High-risk projects are those that come with a greater uncertainty regarding outcomes, potentially offering higher returns alongside increased potential for loss.

Low-risk Proposals

Refers to proposals or projects with a minimal chance of failure or loss, often associated with stable returns.

Forecasting Techniques

Methods or processes used in attempting to predict future events or trends, based on historical data and analysis.

Q6: The price that the writer of a

Q8: The following data are available relating to

Q9: Which of the following sources of energy

Q34: If the hedge ratio for a stock

Q40: Alex Goh is 39 years old and

Q40: To avoid errors in business decisions, it

Q81: Which of the following is an adverse

Q82: Publicly traded firms must prepare audited financial

Q88: Developed by the International Monetary Fund to

Q89: Which of the following is true of