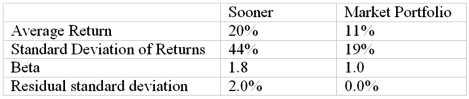

The following data are available relating to the performance of Sooner Stock Fund and the market portfolio:  The risk-free return during the sample period was 3%. Calculate the information ratio for Sooner Stock Fund.

The risk-free return during the sample period was 3%. Calculate the information ratio for Sooner Stock Fund.

Definitions:

Maturity

The date on which a financial instrument or obligation becomes due and is to be paid or settled.

Face Value

The nominal value printed on a bond or stock certificate, representing its legal value.

Straight-Line Method

A depreciation technique that allocates an equal amount of depreciation expense for an asset over its useful life.

Amortization

The process of spreading the cost of an intangible asset over its useful life or paying off a loan in regular installments over a period.

Q7: To determine the optimal risky portfolio in

Q19: Which of the following ratios gives information

Q23: You wish to earn a return of

Q24: Benchmark risk<br>A)is inevitable and is never a

Q24: All of the following factors affect the

Q39: A firm has a higher asset turnover

Q59: Deferral of capital gains tax I) means

Q66: In the context of nontariff barriers, antidumping

Q79: The Gordon model<br>A)is a generalization of the

Q91: Which of the following factors was primarily