Multiple Choice

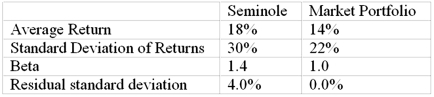

The following data are available relating to the performance of Seminole Fund and the market portfolio:  The risk-free return during the sample period was 6%. If you wanted to evaluate the Seminole Fund using the M2 measure, what percent of the adjusted portfolio would need to be invested in T-Bills

The risk-free return during the sample period was 6%. If you wanted to evaluate the Seminole Fund using the M2 measure, what percent of the adjusted portfolio would need to be invested in T-Bills

Definitions:

Related Questions

Q9: The price that the writer of a

Q10: A firm has a P/E ratio of

Q18: Alan Barnett is 43 years old and

Q33: The manager of Quantitative International Fund uses

Q45: The following price quotations on WFM were

Q46: The Treynor-Black model is a model that

Q55: Suppose that the risk-free rate is 4%

Q59: Investors who take long positions in futures

Q81: You purchased a call option for $3.45

Q86: The financial statements of Snapit Company are