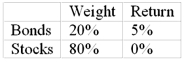

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:  The return on a bogey portfolio was 2%, calculated from the following information.

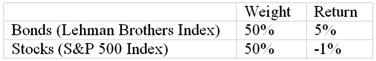

The return on a bogey portfolio was 2%, calculated from the following information.  The contribution of asset allocation across markets to the Razorback Fund's total excess return was

The contribution of asset allocation across markets to the Razorback Fund's total excess return was

Definitions:

Price-Earnings Ratio

A valuation metric for stocks, calculated by dividing the market price of a stock by its earnings per share, indicating the dollar amount an investor can expect to invest in a company to receive one dollar of that company’s earnings.

Common Stock

Equity ownership in a corporation, with shareholders entitled to vote on corporate matters and receive dividends when declared.

Market Price

The present cost at which a product or service can be purchased or sold on the market.

Return on Total Assets

A measure of profitability that indicates how efficiently a company is using its assets to generate earnings.

Q1: Hedge funds are _ transparent than mutual

Q7: The Sharpe, Treynor, and Jensen portfolio performance

Q16: Quotas, boycotts, monetary barriers, and market barriers

Q16: Suppose that the risk-free rates in the

Q26: The Black-Litterman model and Treynor-Black model are<br>A)nice

Q36: Target-date retirement funds<br>A)are funds of funds diversified

Q50: The tracking error of an optimized portfolio

Q70: An exchange permit can stipulate the:<br>A) quantity

Q76: The financial statements of Midwest Tours are

Q110: Which of the following trade policy tools