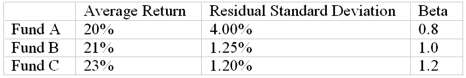

You want to evaluate three mutual funds using the information ratio measure for performance evaluation.The risk-free return during the sample period is 6%, and the average return on the market portfolio is 19%.The average returns, residual standard deviations, and betas for the three funds are given below.  The fund with the highest information ratio measure is

The fund with the highest information ratio measure is

Definitions:

Hypertensive Crisis

A severe and dangerous increase in blood pressure that can lead to stroke, heart attack, or other critical conditions if not treated promptly.

MAO

An enzyme in the body responsible for breaking down neurotransmitters, such as dopamine and serotonin, and involved in the action of certain antidepressants.

Hypoglycemia

A condition characterized by abnormally low blood glucose (sugar) levels.

Q7: Endowment funds are held by<br>A)charitable organizations.<br>B)educational institutions.<br>C)for-profit

Q7: The developed country with the lowest average

Q37: Hedge funds may invest or engage in<br>A)distressed

Q44: General pension funds typically invest _ of

Q57: What is an option hedge ratio<br> How

Q72: Empirical tests of the Black-Scholes option pricing

Q76: The financial statements of Midwest Tours are

Q79: The financial statements of Midwest Tours are

Q80: Suppose you purchase 100 shares of GM

Q86: Which of the following countries has an