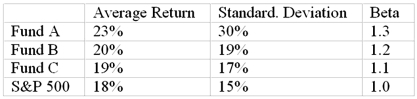

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation.The risk-free return during the sample period is 5%.The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.  The investment with the highest Sharpe measure is

The investment with the highest Sharpe measure is

Definitions:

Responsibility

A duty or obligation to satisfactorily perform or complete a task that one has accepted, or which is imposed by law, duty, or contractual agreement.

Reparation

Compensation or restitution for wrongs or damages, often discussed in the context of historical injustices.

Reconciliation

The act of restoring harmony or agreement between individuals or groups, especially after a conflict or dispute.

Personal Narrative

A person's story or account of their life experiences, often emphasizing a personal journey or transformation.

Q4: Which of the following is a basic

Q10: At expiration, the time value of an

Q10: Which of the following strategies was employed

Q20: An option with an exercise price equal

Q29: The risk profile of hedge funds _,

Q29: Assume that at retirement you have accumulated

Q46: In the infrequent foreign marketing stage of

Q51: Suppose the risk-free return is 6%.The beta

Q55: Which one of the following statements regarding

Q68: By the year 1971, the United States