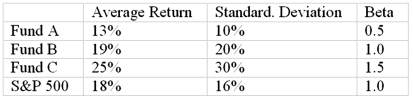

You want to evaluate three mutual funds using the Treynor measure for performance evaluation.The risk-free return during the sample period is 6%.The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index.  The fund with the highest Treynor measure is

The fund with the highest Treynor measure is

Definitions:

Photoreceptors

Cells in the retina of the eye that respond to light, initiating the process of visual perception.

Optic Nerve

A cranial nerve that transmits visual information from the retina to the brain.

Auditory Cortex

Portion of the cerebral cortex that is responsible for the conscious sensation of sound; in the dorsal portion of the temporal lobe within the lateral fissure and on the superolateral surface of the temporal lobe.

Vestibulocochlear Nerve

The eighth cranial nerve that transmits sound and equilibrium (balance) information from the inner ear to the brain.

Q2: The part of the world with the

Q5: Which were the two major challenges faced

Q6: _ are mutual funds that invest in

Q8: Discuss the differences between economic earnings and

Q12: The financial statements of Snapit Company are

Q17: The financial statements of Snapit Company are

Q24: Agricultural futures contracts are actively traded on<br>A)rice.<br>B)sugar.<br>C)canola.<br>D)rice

Q31: Volatility risk is<br>A)the volatility level for the

Q34: The Organization for Economic Cooperation and Development

Q37: Assume that at retirement you have accumulated