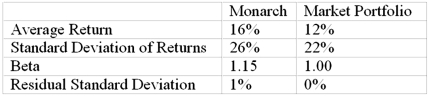

The following data are available relating to the performance of Monarch Stock Fund and the market portfolio:  The risk-free return during the sample period was 4%. Calculate Treynor's measure of performance for Monarch Stock Fund.

The risk-free return during the sample period was 4%. Calculate Treynor's measure of performance for Monarch Stock Fund.

Definitions:

Variable Costs

Expenses that vary in direct proportion to changes in levels of production or sales activity, such as raw materials and direct labor costs.

Net Loss

The amount by which expenses exceed revenues.

Variable Costs

Expenses that vary in relation to the quantity of products or services a company generates.

Fixed Costs

Financial obligations that are stable irrespective of the business's production or sales figures, such as rental payments, salary bills, and insurance.

Q26: The Black-Litterman model and Treynor-Black model are<br>A)nice

Q37: A manager who uses the mean-variance theory

Q44: Discuss marking to market and margin accounts

Q49: Briefly describe the policies that were accepted

Q59: Which of the following is a controllable

Q60: List and briefly explain the domestic environment

Q69: You buy one Home Depot June 60

Q80: The financial statements of Black Barn Company

Q105: A put option on a stock is

Q105: _ is equal to (common shareholders' equity/common