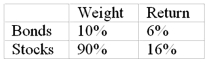

In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in the following asset classes:  The return on a bogey portfolio was 10%, calculated as follows:

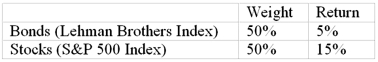

The return on a bogey portfolio was 10%, calculated as follows:  The total excess return on the Aggie managed portfolio was

The total excess return on the Aggie managed portfolio was

Definitions:

Capital Investment

Funds spent by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment to increase operational efficiency.

Future Net Cash Flows

The estimated total cash income minus the total cash expenses expected over a future period.

Net Present Value

The difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Payback Period

The amount of time it takes for an investment to generate enough returns to recover the original investment cost.

Q1: Hedge funds are _ transparent than mutual

Q7: To the option holder, put options are

Q10: The _ equity market had the lowest

Q28: Define international marketing. How it is different

Q40: Alex Goh is 39 years old and

Q41: The _ equity market had the highest

Q53: Which of the following arguments regarding the

Q57: The financial statements of Snapit Company are

Q62: You purchased one wheat future contract at

Q98: Antidumping laws were specifically designed to prevent