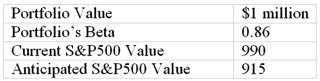

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  If the anticipated market value materializes, what will be your expected loss on the portfolio

If the anticipated market value materializes, what will be your expected loss on the portfolio

Definitions:

Portfolio

A group of investment vehicles comprising stocks, bonds, commodities, as well as cash and its equivalents, together with mutual funds and ETFs.

Adverse Selection

Adverse selection refers to a situation where sellers have information that buyers do not, or vice versa, about some aspect of product quality.

Utility Function

A mathematical representation of how consumers rank different bundles of goods according to their level of satisfaction or utility.

Wealth

The presence of significant financial assets or tangible property that can be transformed into a medium suitable for trade.

Q1: For an individual investor, the value of

Q12: The Treynor-Black model assumes that<br>A)the objective of

Q13: You purchased the following futures contract today

Q18: The financial statements of Black Barn Company

Q18: Which of the following is an uncontrollable

Q36: Regarding hedge fund incentive fees, hedge fund

Q37: Suppose two portfolios have the same average

Q58: Which of the following firms has a

Q89: You purchased one AT&T March 50 call

Q107: A European put option allows the holder