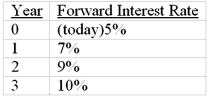

Suppose that all investors expect that interest rates for the 4 years will be as follows:  If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same (Par value of the bond = $1,000)

If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same (Par value of the bond = $1,000)

Definitions:

Dollar Sales

The total revenue a company generates from sales, measured in dollars, over a specific period.

Margin of Safety

The difference between actual or expected sales and the break-even point, indicating the amount by which sales can drop before a company incurs losses.

Break-Even Sales

The amount of revenue required to cover total fixed and variable expenses during a specific period, resulting in no profit or loss.

Current Sales

The total sales revenue that a company generates in the present or most recent accounting period.

Q9: Explain what the following terms mean: spot

Q12: Duration<br>A)assesses the time element of bonds in

Q18: Consider the multifactor APT.There are two independent

Q19: Two firms, C and D, both produce

Q43: The value of a Treasury bond should<br>A)be

Q46: The following is a list of prices

Q49: An example of a highly cyclical industry

Q64: Altman's Z scores are assigned based on

Q78: The _ is defined as the present

Q90: A bond has a par value of