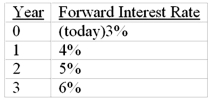

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the price of 3-year zero-coupon bond with a par value of $1,000

What is the price of 3-year zero-coupon bond with a par value of $1,000

Definitions:

Cash Inflows

Refers to the money received by a company during a particular period, including revenues from sales, investments, and financing activities.

Minimum Acceptable Rate

The lowest rate of return on an investment that a manager or investor is willing to accept.

Investment Decision

The process of making choices about where to allocate funds in various assets with the aim of generating returns over time.

Net Cash Flow

The difference between a company's cash inflows and outflows in a given period, indicating how much cash is generated or spent.

Q1: Imposing the no-arbitrage condition on a single-factor

Q10: According to Roll, the only testable hypothesis

Q10: If interest rates decrease, business investment expenditures

Q16: The risk-free rate and the expected market

Q41: As diversification increases, the total variance of

Q48: Investors can use publicly available financial data

Q54: _ is a measure of the extent

Q56: Low Tech Chip Company is expected to

Q86: The financial statements of Snapit Company are

Q91: The maximum loss a buyer of a