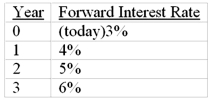

Suppose that all investors expect that interest rates for the 4 years will be as follows:  If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same (Par value of the bond = $1,000.)

If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same (Par value of the bond = $1,000.)

Definitions:

Government Intervention

Actions taken by a government to affect the economy, which can include regulations, subsidies, tariffs, and other forms of involvement.

Market Efficiency

A condition in which all available information is fully reflected in asset prices, making it impossible to consistently achieve higher returns than the overall market.

Equilibrium Price

The price in the market where the amount of products offered matches the amount of products desired.

Socially Optimal

A condition or outcome that is most efficient and beneficial for society as a whole, often considered in economic policies and strategies.

Q3: In the 1972 empirical study by Black,

Q5: The risk-free rate and the expected market

Q13: An extension of the Fama-French three-factor model

Q17: Investment manager Peter Lynch refers to firms

Q24: If you believe in the reversal effect,

Q25: There are three stocks, A, B, and

Q32: Suppose that all investors expect that interest

Q58: Indexing of bond portfolios is difficult because<br>A)the

Q83: A coupon bond that pays interest of

Q125: A coupon bond pays annual interest, has