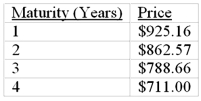

The following is a list of prices for zero-coupon bonds with different maturities and par value of $1,000.  What is the yield to maturity on a 3-year zero-coupon bond

What is the yield to maturity on a 3-year zero-coupon bond

Definitions:

Cash Flow Per Share

A measure of a firm's financial flexibility, calculated as operating cash flow divided by the number of outstanding shares.

Prohibited

Actions or activities that are not permitted or allowed by law, regulation, or policy.

Basic Earnings

Earnings calculated by dividing the net income by the total number of outstanding shares, showing the profit earned per share.

Price/Earnings Ratio

A valuation ratio of a company's current share price compared to its per-share earnings, commonly used by investors to determine stock attractiveness.

Q3: Holding other factors constant, the interest-rate risk

Q8: When computing yield to maturity, the implicit

Q10: According to Roll, the only testable hypothesis

Q46: The growth in dividends of XYZ, Inc.is

Q61: _ is a true statement.<br>A)During periods of

Q72: Consider the multifactor model APT with two

Q82: According to James Tobin, the long run

Q98: The most appropriate discount rate to use

Q103: You wish to earn a return of

Q114: If a 6.75% coupon bond is trading