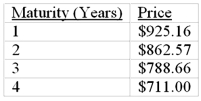

The following is a list of prices for zero-coupon bonds with different maturities and par value of $1,000.  What is, according to the expectations theory, the expected forward rate in the third year

What is, according to the expectations theory, the expected forward rate in the third year

Definitions:

Amortized Loan

A loan with scheduled periodic payments that consist of both principal and interest, designed to pay off the debt over a set period.

Effective Rate

The actual interest rate an investor receives or pays on a financial product, factoring in the effects of compounding.

Amortization Schedule

A table detailing each periodic payment on an amortizing loan, including breakdowns of principal and interest.

Amortizes Loans

Loans for which periodic payments are made that include both interest and principal, gradually reducing the outstanding balance.

Q2: You purchased an annual interest coupon bond

Q3: The expected return-beta relationship of the CAPM

Q16: If the value of a Treasury bond

Q23: Why might the degree of market efficiency

Q31: The duration of a perpetuity with a

Q32: Suppose that all investors expect that interest

Q44: The expectations theory of the term structure

Q55: Which of the following two bonds is

Q73: Siri had a FCFE of $1.6M last

Q82: According to James Tobin, the long run