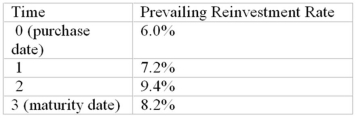

Three years ago you purchased a bond for $974.69.The bond had three years to maturity, a coupon rate of 8%, paid annually, and a face value of $1,000.Each year you reinvested all coupon interest at the prevailing reinvestment rate shown in the table below.Today is the bond's maturity date.What is your realized compound yield on the bond

Definitions:

Standard Error

A measure of the variability or dispersion of a sample statistic from the population parameter.

Confidence Interval

A set of values, obtained from sample data, that probably includes the value of an unspecified population parameter, given a certain confidence level.

Point Estimate

A solitary figure or statistical measure employed to approximate the worth of a population parameter.

Confidence Interval

A portfolio of values, extracted from sampling efforts, believed to encapsulate the undiscovered value of a population attribute.

Q2: The risk-free rate is 7%.The expected market

Q11: Music Doctors just announced yesterday that its

Q31: Although the expectations of increases in future

Q36: The industry life cycle is described by

Q50: A 7.5% coupon bond with an ask

Q67: Suppose the following equation best describes the

Q74: Consider the multifactor model APT with three

Q99: Consider the following $1,000 par value zero-coupon

Q121: You purchased an annual interest coupon bond

Q126: When a bond indenture includes a sinking