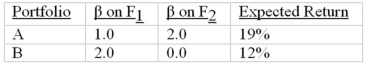

Consider the multifactor APT.There are two independent economic factors, F1 and F2.The risk-free rate of return is 6%.The following information is available about two well-diversified portfolios:  Assuming no arbitrage opportunities exist, the risk premium on the factor F1 portfolio should be

Assuming no arbitrage opportunities exist, the risk premium on the factor F1 portfolio should be

Definitions:

Q11: Mortgage-backed CDOs were a disaster in 2007

Q17: Security X has expected return of 9%

Q18: In the empirical study of a multifactor

Q29: An extension of the Fama-French three-factor model

Q41: The Fama and French three-factor model uses

Q45: A 9% coupon bond with an ask

Q46: According to the Capital Asset Pricing Model

Q48: Jagannathan and Wang (2006) find that the

Q58: The risk-free rate is 4%.The expected market

Q66: In developing the APT, Ross assumed that