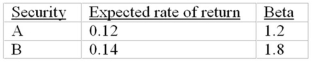

Given are the following two stocks A and B:  If the expected market rate of return is 0.09 and the risk-free rate is 0.05, which security would be considered the better buy and why

If the expected market rate of return is 0.09 and the risk-free rate is 0.05, which security would be considered the better buy and why

Definitions:

Mercury

A chemical element with symbol Hg and atomic number 80, known for being a liquid metal at room temperature and for its toxicity.

Room Temperature

The ambient temperature of a room, generally considered to be between 20 to 25 degrees Celsius (68 to 77 degrees Fahrenheit).

Sodium Sulfate

An inorganic salt used in detergents, paper manufacturing, and glass production, known chemically as Na2SO4.

Atoms

Atoms are the basic units of matter and the defining structure of elements, consisting of a nucleus surrounded by electrons, and classified by the number of protons they contain.

Q7: You sold short 100 shares of common

Q22: Discuss the historical distributions of each of

Q29: The variance of a portfolio of risky

Q33: If a firm's beta was calculated as

Q40: Asset allocation may involve<br>A)the decision as to

Q41: The Fama and French three-factor model uses

Q54: You purchased 100 shares of common stock

Q67: Patty O'Furniture purchased 100 shares of Green

Q69: As the number of securities in a

Q72: A convertible bond has a par value