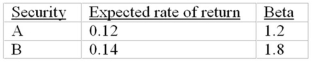

Given are the following two stocks A and B:  If the expected market rate of return is 0.09 and the risk-free rate is 0.05, which security would be considered the better buy and why

If the expected market rate of return is 0.09 and the risk-free rate is 0.05, which security would be considered the better buy and why

Definitions:

Revenues

The total income generated by a firm or organization from its activities, before any expenses are subtracted.

Utility Function

A mathematical representation of how consumer preferences over a set of goods and services are ordered.

Private Consumptions

Expenditures by individuals and households on goods and services for personal use, excluding investments and savings.

Total Amount

The complete or overall sum of quantities or values.

Q6: Term Structure of Interest Rates is the

Q8: Block transactions are transactions for more than

Q14: Suppose that all investors expect that interest

Q40: You want to purchase XON stock at

Q43: Which of the following factors did Chen,

Q50: In the results of the earliest estimations

Q52: When Maurice Kendall first examined stock price

Q81: Suppose you held a well-diversified portfolio with

Q84: The _ gives the number of shares

Q110: Consider two bonds, F and G.Both bonds