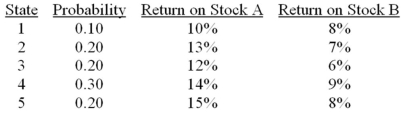

Consider the following probability distribution for stocks A and B:  The standard deviations of stocks A and B are _____ and _____, respectively.

The standard deviations of stocks A and B are _____ and _____, respectively.

Definitions:

Goodwill Impairment

An accounting charge that occurs when the market value of goodwill is less than its recorded value on the balance sheet.

Plant and Equipment

Long-term tangible assets used in the operations of a business to produce goods and services, such as machinery, buildings, and vehicles.

Exchange Gain/Loss

The gain or loss resulting from changes in exchange rates affecting foreign currency transactions.

Exchange Rates

A measurement of the value of one currency expressed in terms of another currency.

Q8: Consider the following probability distribution for stocks

Q9: Standard deviation and beta both measure risk,

Q16: The risk-free rate and the expected market

Q36: You invest 55% of your money in

Q41: In 2012, _ was(were) the least significant

Q57: If the market prices of each of

Q59: Assume that stock market returns do not

Q67: The capital asset pricing model assumes<br>A)all investors

Q74: Consider the multifactor model APT with three

Q76: Suppose the following equation best describes the