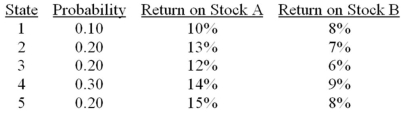

Consider the following probability distribution for stocks A and B:  If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation

If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation

Definitions:

Pure Tone Audiometry

A hearing test that uses sinusoidal tones of specific frequencies to determine an individual's hearing thresholds.

Tympanometry

A diagnostic test that measures the movement of the eardrum in response to changes in air pressure, assessing middle ear function.

Ossicle

Small bones, particularly referring to the three bones found in the middle ear: the malleus, incus, and stapes.

Otoscopy

A medical examination technique that involves looking inside the ear using an instrument called an otoscope.

Q3: The expected return-beta relationship of the CAPM

Q19: According to the Capital Asset Pricing Model

Q26: Name three variables that Chen, Roll, and

Q33: The Yachtsman Fund had NAV per share

Q35: An investor purchased a bond 63 days

Q42: Studies of negative earnings surprises have shown

Q51: In 2012, _ was(were) the most significant

Q57: Your opinion is that CSCO has an

Q63: Suppose the following equation best describes the

Q76: The feature of the APT that offers