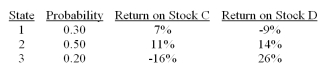

Consider the following probability distribution for stocks C and D:  The standard deviations of stocks C and D are _____ and _____, respectively.

The standard deviations of stocks C and D are _____ and _____, respectively.

Definitions:

Rate of Return

The financial improvement or decline in an investment across a particular period, indicated as a percentage of the investment’s entry cost.

Interest

The fee associated with the right to borrow funds, usually indicated as a yearly percentage rate.

Compounded Annually

This refers to the process of calculating interest on both the initial principal and the accumulated interest from previous periods on a yearly basis.

Retire

To withdraw from one's position or occupation; to conclude one's working or professional career.

Q16: The idea that there is a limit

Q18: The single-index model<br>A)greatly reduces the number of

Q20: Investment bankers<br>A)act as intermediaries between issuers of

Q25: The securities act of 1933 I) requires

Q32: A study by Mehra and Prescott (1985)

Q35: Which of the following orders instructs the

Q51: In 2012, _ was(were) the most significant

Q54: A portfolio has an expected rate of

Q58: Differences between hedge funds and mutual funds

Q61: The security market line (SML)<br>A)can be portrayed