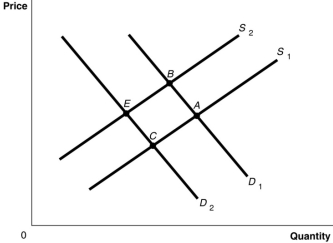

Figure 3.8

-Refer to Figure 3.8.The graph in this figure illustrates an initial competitive equilibrium in the market for sugar at the intersection of D1 and S2 (point B) . If there is a decrease in the price of fertilizer used on sugar cane and there is a decrease in tastes for sugar-sweetened soft drinks, how will the equilibrium point change?

Definitions:

Economic Exposure

Long-term financial risk arising from permanent changes in prices or other economic fundamentals.

Cross-Hedging

Hedging an asset with contracts written on a closely related, but not identical, asset.

Basis Risk

Risk that futures prices will not move directly with the cash price hedged.

May Coffee Futures

Contracts for the future delivery of coffee that are due in May, used for hedging and speculative purposes in the commodities market.

Q30: The cross-price elasticity of demand between Coca-Cola

Q42: For a person to have a comparative

Q66: Suppose that to increase sales of hybrid

Q83: What is opportunity cost?<br>_

Q100: Suppose the cross-price elasticity of demand between

Q112: The Coffee Nook, a small cafe near

Q123: If a consumer receives 20 units of

Q131: If the market price is at equilibrium,

Q137: What would happen in the market for

Q149: Refer to Figure 2.3.Consider the following events: