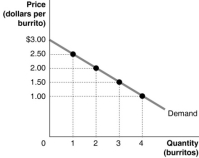

Figure 5.1  Figure 5.1 shows Arnold's demand curve for burritos.

Figure 5.1 shows Arnold's demand curve for burritos.

-Refer to Figure 5.1.If the market price is $1.00, the consumer surplus on the fourth burrito is

Definitions:

Payroll Tax Expense

Taxes that are incurred by an employer based on the salaries and wages of employees, including taxes like Social Security and Medicare in the United States.

FICA

The Federal Insurance Contributions Act tax is a United States federal payroll tax imposed on both employees and employers to fund Social Security and Medicare.

SUTA

State Unemployment Tax Act; a tax paid by employers at a state level to fund unemployment benefits for workers who lose their jobs.

FUTA

The Federal Unemployment Tax Act, which imposes a payroll tax on businesses to fund state workforce agencies.

Q27: Suppose that when the price of chicken

Q29: When you purchase a new set of

Q44: When the actual selling price is above

Q52: Suppose Joe is maximising total utility within

Q74: Technological advancements have led to lower prices

Q92: How does the increasing use of e-books

Q117: If, in a competitive market, marginal benefit

Q143: After getting an A on your economics

Q147: The endowment effect suggests that people<br>A)have a

Q170: Refer to Figure 5.4.The figure above represents