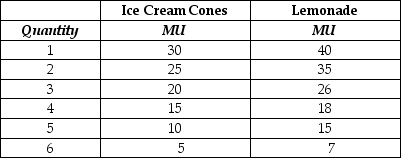

Table 6.3

-Refer to Table 6.3.The table above shows Lee's marginal utility per dollar from consuming ice cream cones and cans of Lemonade.The price of an ice cream cone is $2 and the price of Lemonade is $1.Use this information to select the correct statement.

Definitions:

Absorption Costing

A strategy in accounting where the cost of a product encompasses all the production expenses: direct materials, direct labor, and manufacturing overheads, regardless of them being fixed or variable.

Net Operating Income

An indicator of a firm's earnings derived solely from its principal business activities, without accounting for interest and tax expenses.

Last Year

Refers to the previous calendar or fiscal year.

Absorption Costing

A method of costing that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a product.

Q2: Refer to Figure 7.7.If output is 100

Q57: Studies show that the income elasticity of

Q59: Economists assume people's tastes are identical.

Q83: Economists do not think it is possible

Q108: The sum of consumer surplus and producer

Q118: Which of the following is not a

Q143: Consider the following pairs of items: <br>a.shampoo

Q152: Refer to Figure 7.2.The curve labelled 'E'

Q212: Suppose you pre-ordered a non-refundable movie ticket

Q224: After Suzie, owner of Suzie's Sweet Shop,