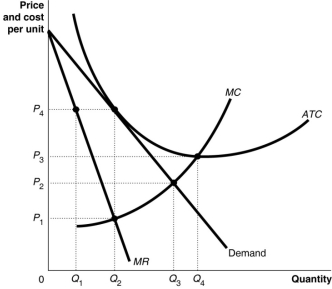

Figure 10.12

-Refer to Figure 10.12.The productively efficient output for the firm represented in the diagram is

Definitions:

Modified Duration

A measure that estimates how the price of a bond will change in response to a change in interest rates, adjusting for the bond's yield to maturity.

Convexity

The curvature of the price–yield relationship of a bond.

Yield

The annual percentage yield received from an investment, including interest or dividends, relative to the cost of that investment.

Rate Anticipation Swap

A switch made between bonds of different durations in response to forecasts of interest rates.

Q5: Refer to Table 12.3.The amount of revenue

Q27: Publishers practice price discrimination when they sell

Q34: What are the three most important variables

Q59: The income effect of a wage increase

Q84: A prisoner's dilemma leads to a non-cooperative

Q106: Refer to Figure 9.10.Compared to a perfectly

Q163: OPEC periodically meets to agree to restrict

Q171: If economies of scale are relatively unimportant

Q178: Which of the following is not an

Q256: Refer to Figure 8.11.Suppose the prevailing price