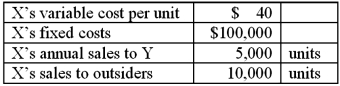

A company has two divisions, X and Y, each operated as an investment center. X charges Y $55 per unit for each unit transferred to Y. Other data are:  X is planning to raise its transfer price to $65 per unit. Division Y can purchase units at $50 each from outsiders, but doing so would idle X's facilities now committed to producing units for Y. Division X cannot increase its sales to outsiders. From the perspective of the short-term profit position of the company as a whole, from which source should Division Y acquire the units?

X is planning to raise its transfer price to $65 per unit. Division Y can purchase units at $50 each from outsiders, but doing so would idle X's facilities now committed to producing units for Y. Division X cannot increase its sales to outsiders. From the perspective of the short-term profit position of the company as a whole, from which source should Division Y acquire the units?

Definitions:

Time

The indefinite continued progress of existence and events in the past, present, and future regarded as a whole.

Business Activities

Various actions undertaken by companies as part of their operation, including production, sales, marketing, and administration.

Ethical Choices

Decisions made based on moral principles, considering what is right and wrong.

Cultural Differences

Variations in beliefs, values, habits, and social practices among people from different backgrounds.

Q5: Oslo Company's target quality characteristic, T, for

Q12: Leading is the process that managers use

Q15: F.W. Taylor advocated the use of a

Q17: Terminal values often lead to the formation

Q43: Differentiate between an open and a closed

Q50: Management is the planning, organizing, leading, and

Q75: The inventory turnover ratio for 2013 is

Q83: A primary goal of transfer pricing is

Q90: If both divisions were presented with an

Q94: Explain what is meant by the term