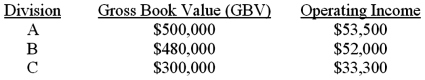

When the Bronx Company formed three divisions a year ago, the president told the division managers an annual bonus would be given to the most profitable division. The bonus would be based on either the return on investment (ROI) or residual income (RI) of the division. Investment is to be measured using gross book value (GBV) or net book value (NBV). The following data are available:

All the assets are long-lived assets that were purchased 15 years ago and have 15 years of useful life remaining. A zero terminal disposal price is predicted. Bronx's minimum rate of return (cost of capital) used for computing RI is 10%.

All the assets are long-lived assets that were purchased 15 years ago and have 15 years of useful life remaining. A zero terminal disposal price is predicted. Bronx's minimum rate of return (cost of capital) used for computing RI is 10%.

Required:

Which method for computing profitability would each manager likely choose? Show supporting calculations. Round percentage answers to 2 decimal places, e.g., 0.1234 as 12.34%. Where applicable, assume straight-line depreciation.

Definitions:

Feasibility

The measure of how viable or possible it is to achieve a proposed project or plan, often assessed in terms of cost, time, resources, and technology.

Value Proposition

The unique value a product or service offers to customers, distinguishing it from competitors.

Revenue Streams

Different sources or methods through which a business generates income from its activities or assets.

Market Share

The portion of a market controlled by a particular company or product, often expressed as a percentage.

Q11: The return on investment (ROI) for Division

Q15: George is an efficient and effective manager

Q26: This question deals with the general topic

Q28: Due to declining global sales, Makeown Ventures

Q60: Production or support SBUs within the firm

Q61: Decentralized firms can delegate authority and yet

Q70: Bureaucracy is a formal system of organization

Q95: Value stream income statements, which are part

Q103: Variable costing operating income for 2013 is

Q110: For Hanson, what is the value of