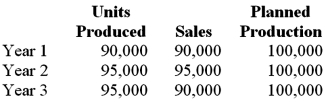

Home Products Inc has failed to reach its planned activity level during its first two years of operation. The following table shows the relationship between units produced, sales, and normal activity for these years and the projected relationship for Year 3. All prices and costs have remained the same for the last two years and are expected to do so in Year 3. Income has been positive in both Year 1 and Year 2.  Because Home Products uses a full costing system, one would predict operating income for Year 3 to be:

Because Home Products uses a full costing system, one would predict operating income for Year 3 to be:

Definitions:

Call Increases

Typically refers to an increase in the price of call options, which are contracts that give the holder the right to buy the underlying asset at a specified price.

Wasting Asset

An asset that inexorably declines in value over time due to physical deterioration or the expiration of intangible rights.

Put Option

An option that gives the owner the right, but not the obligation, to sell an asset.

Call Option

An option that gives the owner the right, but not the obligation, to buy an asset.

Q14: Full costing operating income for 2012 is

Q69: In a Cost of Quality (COQ) framework,

Q69: According to Henri Fayol, esprit de corps

Q71: Which of the following is true of

Q71: Which of the following is an argument

Q82: Restructuring cannot be accomplished by reducing levels

Q100: For production and support departments, a method

Q103: Which of the following is not true

Q110: For Hanson, what is the value of

Q115: Reasons for failure to implement the balanced