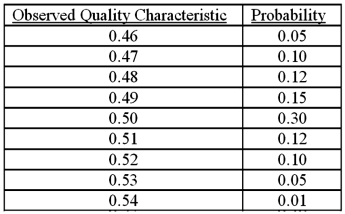

Over the last few months, Ithaca Precision Instruments (IPI) obtained the following measurements on a key quality characteristic of its product:  The company's experience has been that a customer will reject a product that deviates from the target quality characteristic of 0.50 by more than 0.004. Each rejection costs the firm $5. Determine the expected loss of the observed quality characteristic for IPI. Round final steps of calculation to 4 decimal places .

The company's experience has been that a customer will reject a product that deviates from the target quality characteristic of 0.50 by more than 0.004. Each rejection costs the firm $5. Determine the expected loss of the observed quality characteristic for IPI. Round final steps of calculation to 4 decimal places .

Definitions:

Nominal Exchange Rate

The rate at which one currency can be exchanged for another without adjusting for inflation.

Prices

The amount of money required to purchase a good or service.

Arbitrage

The simultaneous purchase and sale of the same asset in different markets to profit from tiny differences in the asset's listed price.

Shrimp

A small, decapod crustacean found in marine and freshwater environments, often consumed as seafood.

Q7: Owing to financial problems in the organization,

Q13: Which of the following items is not

Q22: _ is a management technique that involves

Q35: Heidelberg Manufacturing specifies the quality characteristic for

Q37: The balanced scorecard critical success factors (CSFs)

Q43: Finding a single cost driver that changes

Q57: Assume two divisions, P (producing) and B

Q105: The total amount of the bonus pool

Q115: The partial financial productivity ratio of DTV-12

Q126: The Old Army Jean Company has been