You are provided with the following summary of overhead-related costs for the most recent accounting period for a company that uses a single overhead account, Factory Overhead, into which it records both actual and standard overhead costs during the period:

1. Overhead standard cost variances for the period:

a. Fixed overhead (FOH) spending variance = $1,600U

b. Production volume variance = $200F

c. Variable overhead (VOH) efficiency variance = $1,050U

d. Variable overhead (VOH) spending variance = $150U

2. Actual fixed overhead cost incurred (depreciation) = $15,800; actual variable overhead cost incurred (paid in cash) = $4,800

3. Standard overhead cost applied to production (i.e., WIP inventory) during the period = $18,000

4. Standard overhead cost of units transferred to Finished Goods Inventory = $20,000

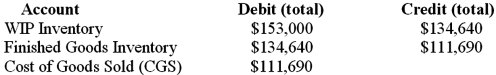

5. Before closing its accounts at the end of the period, the (standard cost) amounts affecting the inventory and CGS accounts is as follows:  Required: Prepare the proper journal entry for each of the following events:

Required: Prepare the proper journal entry for each of the following events:

1. Incurrence of actual FOH costs for the period.

2. Incurrence of actual VOH costs for the period.

3. Application of standard overhead costs to production (i.e., WIP inventory).

4. Recording of standard overhead costs for units completed during the period.

5. Recording of the four standard cost variances for the period.

6. Closing the standard cost variances under the assumption that the company closes these variances entirely to Cost of Goods Sold (CGS).

7. Closing the standard cost variances under the assumption that the company prorates the variances to the CGS and inventory accounts.

Definitions:

Constructive Stress

A level of stress that leads to positive effects, such as improved focus and enhanced productivity.

Destructive Stress

Refers to excessive levels of stress that impair an individual's health, well-being, and performance, as opposed to constructive stress that can stimulate motivation.

Coping Mechanisms

Coping mechanisms are strategies or actions that individuals use to manage stress, challenges, or emotional conflict.

Types of Diversity

The various forms in which diversity can manifest, including but not limited to racial, ethnic, gender, age, cultural, and cognitive diversity.

Q2: In a Cost of Quality (COQ) framework,

Q11: Joint (common) costs in a joint production

Q18: High Point Furniture manufactures a high-quality dining

Q39: Which of the following is not a

Q57: The actual amount of operating income earned

Q77: McElroy Company has prepared the following master

Q80: The Sand Cruiser is a takeout food

Q125: The direct labor efficiency variance for December

Q127: The partial direct labor operational productivity in

Q133: Which of the following is NOT one