You are provided with the following summary of overhead-related costs for the most recent accounting period for a company that uses a single overhead account, Factory Overhead, into which it records both actual and standard overhead costs during the period:

1. Overhead standard cost variances for the period:

a. Fixed overhead (FOH) spending variance = $1,600U

b. Production volume variance = $200F

c. Variable overhead (VOH) efficiency variance = $1,050U

d. Variable overhead (VOH) spending variance = $150U

2. Actual fixed overhead cost incurred (depreciation) = $15,800; actual variable overhead cost incurred (paid in cash) = $4,800

3. Standard overhead cost applied to production (i.e., WIP inventory) during the period = $18,000

4. Standard overhead cost of units transferred to Finished Goods Inventory = $20,000

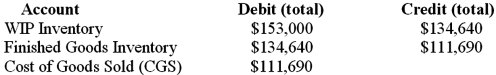

5. Before closing its accounts at the end of the period, the (standard cost) amounts affecting the inventory and CGS accounts is as follows:  Required: Prepare the proper journal entry for each of the following events:

Required: Prepare the proper journal entry for each of the following events:

1. Incurrence of actual FOH costs for the period.

2. Incurrence of actual VOH costs for the period.

3. Application of standard overhead costs to production (i.e., WIP inventory).

4. Recording of standard overhead costs for units completed during the period.

5. Recording of the four standard cost variances for the period.

6. Closing the standard cost variances under the assumption that the company closes these variances entirely to Cost of Goods Sold (CGS).

7. Closing the standard cost variances under the assumption that the company prorates the variances to the CGS and inventory accounts.

Definitions:

Government Intervention

The actions taken by a government to influence or regulate various activities within its economy.

Pigouvian Taxes

Taxes imposed on activities that generate negative externalities, aiming to correct market outcomes by aligning private costs with social costs.

Sulfur Dioxide Emissions

Refers to the release of sulfur dioxide gas into the atmosphere, primarily from burning fossil fuels, which can cause environmental and health problems.

Excise Taxes

Taxes charged on the sale of specific goods and services, such as alcohol and tobacco, often used as a tool for discouraging their consumption.

Q13: Which one of the following, for each

Q15: For Cost of Quality (COQ) reporting purposes,

Q32: What is the least amount of monthly

Q34: Which of the following statements regarding capital

Q60: Durable Inc. is considering replacing an old

Q62: The hurdle rate for accepting new capital

Q74: Calculate this asset's book (accounting) rate of

Q86: The direct materials usage variance for July

Q119: The difference between the actual operating income

Q152: Income tax effects are associated with all