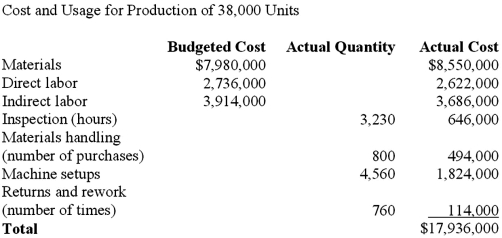

DualShaft Inc. manufactures a wide variety of parts for recreational boating, including boat engines. The component is purchased by OEM (original equipment manufacturers) such as Mercury and Honda, for use in the larger and more powerful outboards. The units sell for $790, and sales volume averages 38,000 units per year. Recently, DualShaft's major competitor lowered the price of the equivalent part to $710. The market was very competitive, and DualShaft realized it had to meet the new price or lose significant market share. The controller assembled the following data for the most recent year.  Required:

Required:

1. Calculate the target cost for maintaining current market share and profitability.

2. How should the company attempt to reduce cost to meet the new target cost?

Definitions:

Red Scare

A period of intense anti-communist suspicion in the United States that occurred in the early 20th century, characterized by fears of widespread communist influence on American institutions and espionage by Soviet agents.

United States

A country primarily located in North America, consisting of 50 states, a federal district, five major self-governing territories, and various possessions.

Archduke Franz Ferdinand

Heir presumptive to the Austro-Hungarian throne whose assassination in 1914 triggered World War I.

Q15: Lau & Lau, Ltd., of Hong Kong

Q16: Explain the calculation and interpretation of a

Q18: The machine-hour constraint for Harrington's linear program

Q62: "Firms need to use the capacity of

Q77: Baldwin produces bicycles in a highly competitive

Q79: The practice of setting prices below average

Q92: Which of the following statements regarding cost

Q112: In deciding whether to drop or keep

Q118: Assume that cash inflows occur evenly throughout

Q172: Let "AQ" = actual quantity of direct