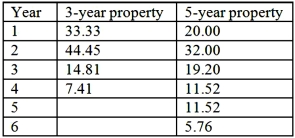

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine will produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years. Marc's combined income tax rate is 40%. Management requires a minimum after-tax rate of return of 10% on all investments. A partial MACRS depreciation table is reproduced below.  What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

Definitions:

Socially Isolated

Describes an individual who experiences a lack of social connections, interactions, or relationships, often leading to feelings of loneliness.

Retirement

The period of a person's life when they choose to permanently leave the workforce behind, typically due to age or health.

SES (Socioeconomic Status)

A measure of an individual's or family's economic and social position in relation to others, based on income, education, and occupation.

Life Span

The duration of time that an individual lives, from birth to death.

Q18: The total under or over applied overhead

Q24: Throughput margin is defined as sales less:<br>A)Direct

Q43: In order to reduce costs so as

Q44: The overhead production volume variance for Megan,

Q61: Which of the following is a common

Q100: The degree of operating leverage (DOL) at

Q101: The sales dollars required for Kelvin Co.

Q143: All of the following capital budgeting decision

Q145: Transcript Company is preparing a cash budget

Q158: The standard cost per pound of PPS