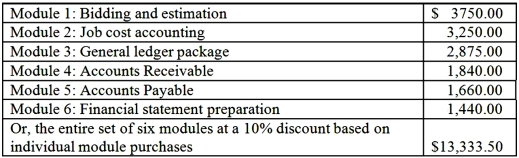

Acorn Corporation designs and installs fire-suppression systems in commercial buildings. Over 90 percent of Acorn's business is in new construction, with the remainder in upgrade installations in remodeled buildings. For planning and control purposes, Acorn's controller (Jane Reid) is considering purchasing cost and financial accounting software from Constructor Solutions. Costs for the software modules are shown below:  Required:

Required:

1. Jane uses value-chain analysis in evaluation of capital investments. She asks you which method, internal rate of return (IRR) or net present value (NPV), would be best in selecting individual software modules, and your reason(s) for the choice of method.

2. Jane says, "If we buy the entire set of six modules, we will get the equivalent of Module 6 free." Why might this savings of almost $1,500 be illusory?

3. The present value of the cost savings generated by the set of six modules, based on a five-year life and discount rate of 18 percent, is estimated as $13,844.50. Should the set be purchased? Explain. How would your decision be affected if Acorn's minimum rate of return were 24 percent? (No calculations are necessary to answer this question.)

Definitions:

Portfolio Planning

A strategic approach in which investments or projects are selected and managed as a portfolio, considering the balance of risk and reward to achieve overall objectives.

Investments

The act of allocating resources, usually money, with the expectation of generating an income or profit.

SWOT Analysis

A strategic planning tool used to identify and understand an organization’s Strengths, Weaknesses, Opportunities, and Threats.

Substitute Products

Products that serve as alternatives to each other; when the price of one increases, the demand for the alternative typically increases.

Q9: PureSwing Golf, Inc. manufactures swing analyzer systems

Q13: Especially for projects with long lives, estimation

Q28: Salich Manufacturing Corporation has provided the following

Q40: Which of the following is different in

Q62: The standard direct labor rate per hour

Q84: Suppose that Capital One's management believes that

Q89: Power Cords Corp.'s margin of safety (MOS)

Q99: Data collected on the cost objects and

Q129: Under the assumption that the company would

Q138: The total operating income variance for a