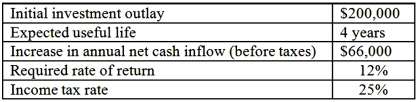

Harris Corporation provides the following data on a proposed capital project:  Harris uses straight-line depreciation method with no salvage value.

Harris uses straight-line depreciation method with no salvage value.

Required: Compute for this investment project:

1. NPV (the PV annuity factor for 12%, 4 years is 3.037)

2. IRR (to the nearest tenth of a percent). Note: PV annuity factors for 4 years: @ 8% = 3.312; @ 9% = 3.240; @ 10% = 3.170; @ 11% = 3.102; @ 12% = 3.037; and, @ 13% = 2.974)

3. Payback period (assume that cash inflows occur evenly throughout the year).

4. Accounting rate of return (ARR) on the net initial investment.

5. Discounted payback period (assume that the cash inflows occur evenly throughout the year; round your answer to 2 decimal places). The appropriate PV factors for 12% are as follows: year 1 = 0.893; year 2 = 0.797; year 3 = 0.712; year 4 = 0.636.

Definitions:

Environmental Effects

The impact of human activities on the natural environment, often concerning pollution, habitat destruction, and climate change.

Dependency Theory

A theory that suggests developing nations remain impoverished and dependent due to the exploitation and influence of developed nations.

World Stratification

This term describes the hierarchical layering of countries, often based on economic status, such as developed, developing, and underdeveloped, highlighting global inequalities.

Economic Development

The process of improving the economic well-being and quality of life for a community or country by increasing income, reducing poverty, and managing sustainable growth.

Q9: Fixed costs will often be irrelevant for

Q10: EZ Carry Corp. is the maker of

Q19: In a joint production process, the allocation

Q23: A characteristic of the payback method (before

Q38: The percent of the total variance that

Q66: Profit before taxes for the Bskin product,

Q97: Precilla's standard price per pound of direct

Q110: Technology and complexity issues often lead management

Q124: For a direct material, which one of

Q146: The type of compensation plan that focuses