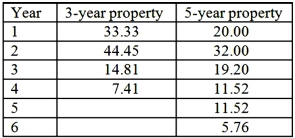

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine can produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years. Marc's income tax rate is 40%. Management requires a minimum of 10% return on all investments. A partial MACRS depreciation table is reproduced below.  Required:

Required:

1. What is the payback period for the new machine (rounded to the nearest tenth of a year)? Assume for purposes of this calculation that the cash inflows occur evenly throughout the year.

2. What is the book (accounting) rate of return (rounded to the nearest whole percent) based on the initial investment and on average after-tax income over the five-year period?

3. What is the book (accounting) rate of return, based on the average investment, where the latter is determined as a simple average of beginning-of-project and end-of-project book value of the asset?

Definitions:

Coordination

The ability to use different parts of the body smoothly and efficiently together or to organize activities harmoniously.

Learning

The process of acquiring new understanding, knowledge, behaviors, skills, values, or preferences.

Reticular Formation

A complex network of nerve pathways in the brainstem connecting the spinal cord, cerebrum, and cerebellum, and mediating overall level of consciousness.

Vital Reflexes

Involuntary responses to specific stimuli that are essential for maintaining homeostasis and survival, such as the blink or gag reflex.

Q2: Using the high-low method, unit variable overhead

Q11: Generally speaking, when ranking two mutually exclusive

Q16: The p-value is a measure of:<br>A)The precision

Q25: Which of the following statements regarding real

Q26: General Manufacturing's budgeted purchases of raw materials

Q35: The capital budgeting decision technique that reflects

Q57: Which of the following statements regarding "opportunity

Q70: The difference between the total actual sales

Q109: The contribution margin per case for Lemonade

Q140: The direct labor rate variance is:<br>A)$36,900 unfavorable.<br>B)$37,800