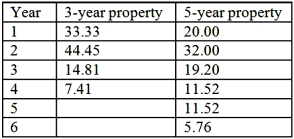

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine can produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years. Marc's income tax rate is 40%. Management requires a minimum of 10% return on all investments. A partial MACRS depreciation table is reproduced below.  Required:

Required:

1. What is the estimated net present value of the investment (rounded to the nearest whole dollar)? (Note: PV $1 factors for 10% are as follows: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; the PV annuity factor for 10%, 5 years = 3.791.) Assume that all estimated cash flows occur at year-end.

2. What is the present value payback period (rounded to two decimal points)?

Definitions:

Alcohol

A chemical compound commonly found in beverages such as beer, wine, and spirits, known for its psychoactive effects.

Omnipotent

Possessing unlimited power and able to do anything.

Stem Cells

Undifferentiated biological cells that can differentiate into specialized cells and can divide to produce more stem cells.

Recessive

Describing traits or genes that are expressed in offspring only when inherited from both parents, as opposed to dominant traits that are expressed when inherited from just one parent.

Q23: A characteristic of the payback method (before

Q30: Prokp's total standard direct labor cost for

Q48: Which one of the following is correct

Q73: What is the variable overhead (VOH) spending

Q78: Which of the following would not likely

Q78: What was Mandy's actual direct labor rate

Q90: If 24,000 hats were sold, Grant's operating

Q120: The direct labor flexible-budget variance is:<br>A)$18,900 unfavorable.<br>B)$42,300

Q150: What is the estimated book (accounting) rate

Q154: Chapter 14 introduces you to the concept