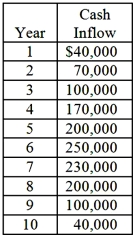

Nelson Inc. is considering the purchase of a $600,000 machine to manufacture a specialty tap for electrical equipment. The tap is in high demand and Nelson can sell all that it could manufacture for the next ten years, the government exempts taxes on profits from new investments. This legislation will most likely remain in effect in the foreseeable future. The equipment is expected to have ten years of useful life with no salvage value. The firm uses the double-declining-balance depreciation method and switches to the straight-line depreciation method in the last four years of the asset's 10-year life. Nelson uses a rate of 10% in evaluating its capital investments. The net cash inflows are expected to be as follows:  Required:

Required:

1. Under the assumption that cash inflows occur evenly throughout the year, what is the estimated payback period for this investment (round your answer to two decimal points)?

2. What is the estimated book (accounting) rate of return (ARR) based on initial investment (rounded)?

3. What is the estimated book (accounting) rate of return (ARR) based on average investment, where "average investment" is defined as a simple average of the beginning-of-project book value and the end-of-project book value of the asset?

Definitions:

Sarcolemma

The Sarcolemma is the cell membrane surrounding muscle fibers, critical for receiving and conducting stimuli and maintaining the integrity of muscle cells.

Clostridium Botulinum

A bacterium that produces botulinum toxin, which can cause botulism, a serious and potentially fatal illness.

Neuromuscular Junction

A synapse between a motor neuron and skeletal muscle cell, enabling nerve impulses to trigger muscle contraction.

ACh

Acetylcholine, a neurotransmitter involved in muscle activation, memory, and learning.

Q25: The direct labor rate variance for November

Q32: A firm uses a JIT inventory system

Q35: If the profit per unit is maintained,

Q46: Which one the following is a variable

Q77: Contrast operating budgets and financial budgets. How

Q79: Garner Stores, Inc. is a multiple-store chain

Q79: The practice of setting prices below average

Q104: The cost described in situations III and

Q164: ABN Corp. has the following information about

Q171: Fill in the unknowns A through S