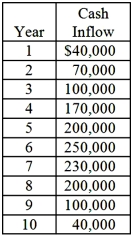

Nelson Inc. is considering the purchase of a $600,000 machine to manufacture a specialty tap for electrical equipment. The tap is in high demand and Nelson can sell all that it could manufacture for the next ten years, the government exempts taxes on profits from new investments. This legislation will most likely remain in effect in the foreseeable future. The equipment is expected to have ten years of useful life with no salvage value. The firm uses the double-declining-balance depreciation method and switches to the straight-line depreciation method in the last four years of the asset's 10-year life. Nelson uses a rate of 10% in evaluating its capital investments. The net cash inflows are expected to be as follows:  Note: PV $1 factors, at 10%: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; year 6 = 0.564; year 7 = 0.513; year 8 = 0.467; year 9 = 0.424; year 10 = 0.386. The PV annuity factor for 10 years, 10% = 6.145.

Note: PV $1 factors, at 10%: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; year 6 = 0.564; year 7 = 0.513; year 8 = 0.467; year 9 = 0.424; year 10 = 0.386. The PV annuity factor for 10 years, 10% = 6.145.

Required:

1. What is the estimated net present value (NPV) of this proposed investment, rounded to the nearest thousand?

2. What is the estimated internal rate of return (IRR) on this project, rounded to the nearest whole % (e.g., 20%)? (Note: Students would have to have access to Excel in order to answer this question.)

3. What is the present value payback period for this proposed investment, in years (rounded to two decimal places)?

Definitions:

Court of Federal Claims

The Court of Federal Claims is a federal court that handles cases involving monetary claims against the U.S. government.

U.S. District Court

The general trial courts of the United States federal court system where civil and criminal cases are filed and heard.

U.S. Tax Court

A federal court that provides taxpayers a venue to dispute tax assessments made by the Internal Revenue Service.

Form 1040EZ

A simplified tax form for U.S. taxpayers with straightforward tax situations, but it was phased out after the 2017 tax year.

Q6: Gralyn Corp. compares two products' margin of

Q30: What is the overhead production volume variance

Q40: Smith Co., maker of high-quality eyewear, incurs

Q45: If the net present value (NPV) of

Q66: OutlyTech's margin of safety (MOS) in units

Q91: Enterprise Tax Services (ETS) provides tax planning.

Q101: How should the cost function be properly

Q102: Consider two projects, A and B. The

Q108: Which of the following is not used

Q134: A 15% internal rate of return (IRR)