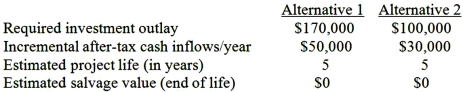

Slumber Company is considering two mutually exclusive investment alternatives. Its estimated weighted-average cost of capital, used as the discount rate for capital budgeting purposes, is 10%. Following is information regarding each of the two projects:  Required:

Required:

1. Compute the estimated net present value of each project and determine which alternative, based on NPV, is more desirable. (The PV annuity factor for 10%, 5 years, is 3.7908.)

2. Compute the profitability index (PI) for each alternative and state which alternative, based on PI, is more desirable.

3. Why do the project rankings differ under the two methods of analysis? Which alternative would you recommend, and why?

Definitions:

Q9: Budgeting provides all of the following except:<br>A)A

Q33: Which of the following statements regarding CVP

Q38: The percent of the total variance that

Q65: HJM Auto Parts makes a muffler/pipe assembly

Q82: Using regression analysis, what is the estimated

Q115: Which of the following is not usually

Q126: The difference between actual and standard cost

Q130: The act of encouraging non-value-adding actions on

Q131: The direct labor efficiency variance for July

Q162: The amount A is:<br>A)$102,080.<br>B)$103,440.<br>C)$105,600.<br>D)$108,000.<br>E)Impossible to determine without