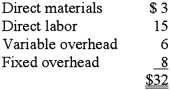

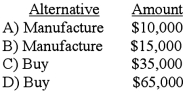

Plainfield Company manufactures part G for use in its production cycle. The costs per unit for 10,000 units of part G are as follows:  Verona Company has offered to sell Plainfield 10,000 units of part G for $30 per unit. If Plainfield accepts Verona's offer, the released facilities could be used to save $45,000 in relevant costs in the manufacture of part H. In addition, $5 per unit of the fixed overhead applied to part G would be totally eliminated. What alternative is more desirable and by what amount?

Verona Company has offered to sell Plainfield 10,000 units of part G for $30 per unit. If Plainfield accepts Verona's offer, the released facilities could be used to save $45,000 in relevant costs in the manufacture of part H. In addition, $5 per unit of the fixed overhead applied to part G would be totally eliminated. What alternative is more desirable and by what amount?

Definitions:

Withholding Allowances

Claims made on an employee's W-4 form that determine the amount of federal income tax withheld from their paycheck.

Gross Wages

Gross wages are the total earnings of an employee before any deductions like taxes, retirement contributions, and health insurance premiums are made.

Form 4070

A form used by employees to report their tips to their employer.

FICA Withholding

The process of deducting Social Security and Medicare taxes from employees' paychecks, as mandated by the Federal Insurance Contributions Act.

Q7: Helen Auger has seen the Centicle Group,

Q29: If the profit per unit is maintained,

Q45: Sales forecasting by its nature is:<br>A)Precise.<br>B)Deterministic in

Q58: Which of the following is not considered

Q61: What is the estimated total cost at

Q75: A favorable cost variance of significant magnitude:<br>A)Is

Q91: Enterprise Tax Services (ETS) provides tax planning.

Q122: Total budgeted cash collections for Yekstop Corp.

Q123: Two investments have the same total cash

Q137: As indicated in the text, one of