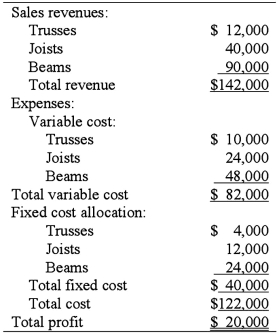

Lester-Smith Company manufactures three wood construction components: wood trusses, wood floor joists, and beams. The plant is operating at full capacity. It can produce 200 trusses, 1,000 joists, and 600 beams per month and sells everything it produces. The monthly revenues and expenses for the three products are  Required:

Required:

1. The firm makes wood trusses mainly to satisfy certain customers by offering a full line of wood components. Lately, it has had a problem making a profit on the trusses and is considering buying them from another manufacturer at $55 a truss. Based solely on a short-term financial analysis, should the firm buy these trusses or continue to make its own? (Show calculations.)

2. Lester-Smith has an opportunity to produce an additional 400 beams for a customer at a price of $100 each. If it accepts this special order, the firm cannot produce trusses because the plant will be operating at full capacity. Should the firm accept this special order? (Show calculations.)

Definitions:

Financial Leverage

The use of borrowed funds to increase the potential return on investment, often measured by the ratio of a company’s debt to equity.

Financial Leverage

Financial leverage refers to the use of borrowed funds to increase the potential return of an investment, amplifying both potential gains and losses.

ROE

Return on Equity, a financial ratio that measures the profitability of a firm relative to shareholders' equity, indicating how efficiently a company uses investments to generate earnings growth.

EPS

Earnings Per Share; a key financial metric that divides a company's profit by the outstanding shares of its common stock.

Q15: The process of identifying, evaluating, selecting, and

Q24: Blake Company has $15,000 cash at the

Q29: If the profit per unit is maintained,

Q36: Which one of the following is true

Q37: A company owns equipment that is used

Q79: Garner Stores, Inc. is a multiple-store chain

Q90: Place the following phases of the departmental

Q103: The estimated value of a real option:<br>A)Is

Q106: Management requires a minimum of 10% return

Q118: Assume that cash inflows occur evenly throughout