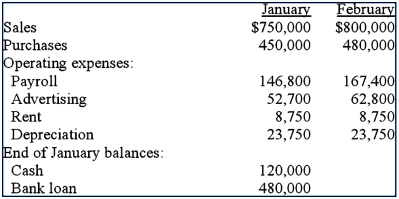

Olde Corporation is preparing a cash budget for the first two months of the coming year. The following data have been forecasted:  Additional data:

Additional data:

(1) Sales are 40% cash and 60% credit. The term of credit sales is 2/10, n/30. The collection pattern for credit sales is 80% in the month following the month of sale (of which 75% are collected within 10 days), and 20% in the month thereafter. Total sales in December of the prior year were $1,000,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance the following month.

(3) Operating expenses are paid in the month incurred.

(4) The firm desires to maintain its cash balance at $150,000 at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made (at the end of the month) whenever the cash balance exceeds $150,000.

Required: Prepare the cash budget, in the form of a statement of cash flow, for February. What is the amount of the loan balance at the end of the month (after loan repayments, if any)?

Definitions:

Per-Unit Tax

A tax applied to a product based on the quantity sold, rather than the value, often leading to a direct increase in the product's price.

Buyers

Individuals or entities that purchase goods or services for personal use, resale, or production of other goods.

Price Paid

Refers to the amount of money exchanged for a good or service at the time of the transaction.

Per-Unit Tax

A fixed amount of tax imposed on each unit of a good or service sold.

Q15: Which one of the following is defined,

Q19: Assume that cash inflows occur evenly throughout

Q22: Total equivalent units for conversion under the

Q35: Compare and contrast traditional budgeting and activity-based

Q38: In situations where a firm specifies different

Q53: The amount of joint costs allocated to

Q74: Calculate this asset's book (accounting) rate of

Q75: The management accountant at Jang Manufacturing Co.

Q105: Luther Company, located in Largeville, Kansas, is

Q108: Brownsville's budgeted cost of inventory purchased in