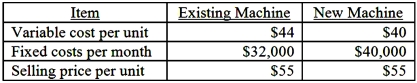

Grey Company is considering replacing its existing cutting machine with a new machine that, according to the manufacturer, is more efficient in terms of energy consumption-a variable cost of production. In this regard, it would like to do some financial planning, including "what-if" analysis. Budgeted information regarding the two machines is as follows:  Required:

Required:

1. Determine the sales volume at which the costs are the same for both machines.

2. What amount of sales, in dollars, for the new machine would produce a 10% profit margin (i.e. ratio of operating profit to sales = 10%)?

Definitions:

Overhead Volume Variance

The difference between the budgeted and actual overhead costs, attributable to variations in production volume.

Fixed Overhead Items

Costs that do not change with the level of production or sales over a certain range, such as rent, salaries, and insurance.

Material Price Variances

The difference between the actual cost of materials and the standard cost multiplied by the actual quantity of materials used.

Cost Control

The process of monitoring and managing the expenses of a business to adhere to a budget or increase profitability.

Q2: Williams Corporation's Department A has the following

Q7: Regression analysis is better than the high-low

Q10: What is the amount of net income

Q15: What are the total conversion costs of

Q17: The tax impact of a capital investment

Q49: Which of the following is not an

Q53: Solich Company is evaluating a new tractor

Q71: What price will the company charge if

Q83: The amount of joint costs allocated to

Q88: Relevant costs in a make-vs.-buy decision of