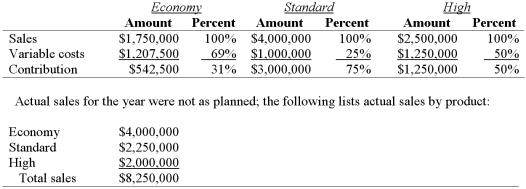

Hightech Company recently developed the technology necessary to produce a low-end, a medium-end, and high-end computer memory chip for heart monitoring healthcare equipment. Budgeted fixed costs for the manufacture of all three products total $4,250,000. The budgeted sales by product and in total for the coming year are as follows:  Required:

Required:

1. Prepare a contribution income statement for the year based on actual sales data (but budgeted cost data, for both variable and fixed costs).

2. Compare the breakeven sales dollars for the year based on both budgeted and on actual sales, assuming that the sales mix remains constant in terms of sales dollars. (Round contribution margin ratios, in all calculations, to three decimal places. Round answer in dollars up, to the nearest whole number.)

3. The company president knows that total actual sales were $8,250,000 for the year, the same as budgeted. Because she had seen the budgeted income statement, she was expecting a nice profit from producing the memory chips. Explain to her what happened.

Definitions:

Resources Are Scarce

The principle that the availability of natural, human, and capital resources is limited, necessitating choices about their allocation and use.

Normative Statements

Statements that express opinions on how the world ought to be, involving value judgments rather than factual claims.

Expressions Of Facts

Statements that aim to convey information about reality or actual events without alteration.

Economic Model

A simplified representation or framework that economists use to describe and analyze economic processes, relationships, or phenomena.

Q18: The journal entry required to record factory

Q35: Activity-based costing (ABC) differs from other costing

Q41: Which of the following is not one

Q56: Joe Green Enterprises has met all production

Q76: Pairing Company has the following cost drivers

Q103: What is the total manufacturing overhead for

Q105: Luther Company, located in Largeville, Kansas, is

Q110: A truck, costing $25,000 and uninsured, was

Q111: The major problem with relevant cost determination

Q140: Using activity-based costing, applied miscellaneous factory overhead