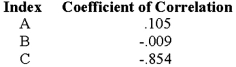

As a preliminary step in the selection of variables to use in a statistical-forecasting model, the management accountant has calculated the coefficient of correlation between the firm's sales and three economic indexes. The results were as follows:  Which of the following statements indicates the best course of action for the auditor to take in the development of a forecasting model?

Which of the following statements indicates the best course of action for the auditor to take in the development of a forecasting model?

Definitions:

Merger

The combination of two or more companies into a single entity, often to achieve synergy and enhance competitiveness.

Corporate Statements

Corporate statements are official documents or declarations issued by a company that communicate information on its activities, financial performance, and strategies.

Takeover Disadvantages

Potential negative impacts of a corporate takeover, such as job losses, cultural clashes, and increased debt.

Corporate Funds

Money or assets owned by a corporation, used in the operation of the business or for the benefit of its shareholders.

Q9: The Time Equation is used in ABC

Q19: The fifth and final step in determining

Q25: When a firm has surplus capacity as

Q27: A significant advantage of using either an

Q66: Maintaining a constant production level in a

Q71: Given a selling price per unit of

Q78: The amount of joint costs allocated to

Q96: A special sales order is:<br>A)Typically expected.<br>B)A profitable

Q121: As indicated in the text, sensitivity analysis

Q134: Critics (e.g., The Beyond Budgeting Roundtable) of