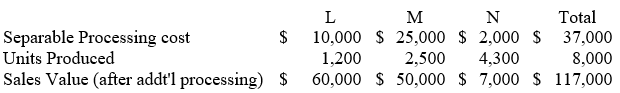

Harmon Inc. produces joint products L, M, and N from a joint process. Information concerning a batch produced in May at a joint cost of $75,000 was as follows:

The amount of joint costs allocated to product M using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Total Income

Total Income refers to the aggregate earnings of an individual or organization from all sources before any deductions are made.

Benefits-received Principle

The concept that individuals should pay taxes in proportion to the benefits they receive from government services.

Gasoline Tax

A levy imposed by governments on the sale of gasoline, used primarily to fund transportation initiatives.

Lump-sum Tax

A fixed tax amount not dependent on the taxpayer's income level or financial transactions.

Q15: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2360/.jpg" alt=" There is insufficient

Q28: If a budgeted activity base is used

Q47: Standard costs are:<br>A)Planned costs the firm should

Q50: Activity-based costing for manufacturing operations is used

Q54: Amos and Son Manufacturing Company of Asheville,

Q59: Which one of the following is the

Q62: Dye Co. uses a job cost system

Q95: Which one of the following would not

Q104: Which of the following is a batch-level

Q130: Altima Company uses an overhead costing system