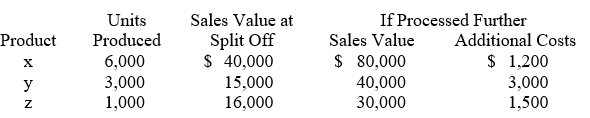

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product X using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product X using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Reconciling Columns

The process of ensuring two sets of figures or account balances agree or match, often used in accounting.

Investing Activities

Transactions involving the purchase and sale of long-term assets and other investments not included in cash equivalents.

Financing Activities

Transactions and events where a company raises capital or repays investors, including issuing shares or borrowing money.

Direct Method

A method for preparing the cash flow statement that lists major classes of gross cash receipts and payments.

Q6: Place the following Process costing steps in

Q11: The calculation of an amount given different

Q38: The estimated cash collections during July from

Q45: Sales forecasting by its nature is:<br>A)Precise.<br>B)Deterministic in

Q51: Which one of the following methods uses

Q55: Normal spoilage is defined as:<br>A)Spoilage that occurs

Q62: Dye Co. uses a job cost system

Q74: The total cost accumulated in the assembly

Q79: Using ABC, what is the overhead cost

Q129: Which of the following would likely be