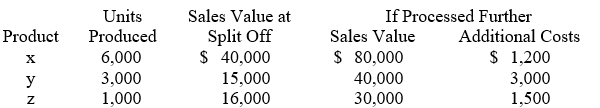

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product Y using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product Y using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Abstracting

The process of extracting essential information from a larger set of data or text to summarize or create a distilled version of the original content.

External Cause Codes

Codes used in medical classification to describe the circumstances or events that cause an injury or health condition.

Volunteer Activity

Volunteer activity encompasses any action or service performed willingly by an individual without financial or material compensation.

Preventive Medicine Codes

Codes used in healthcare billing and documentation to signify procedures and consultations that focus on preventing diseases or identifying them early on to halt their progression.

Q13: The total cost accumulated in the finishing

Q15: The total cost accumulated in the sales

Q16: Which one of the following methods of

Q22: Which of the following items is NOT

Q27: The Tee Box is a golf shop

Q51: Using ABC, overhead cost assigned to Job

Q57: If a costing system uses a single

Q67: For the purposes of cost accumulation, which

Q68: Which of the following would not be

Q146: The type of compensation plan that focuses